I am finally returning to my series on the broken business model of American higher education. In previous installments of this series, I have indicated that I believe the sprawling educational multiplex on which the United States relies and to which much of the world admiringly looks for leadership is sputtering and struggling to catch its breath, I think American higher education is caught between a rock and a hard place. I am convinced that it has reached an important fork in its road. Which way should we go? The future prosperity of American higher education is potentially at stake.

I suspect many of you are cringing at my use of the word prosperity with respect to higher education. I intentially used the business term “prosperity” in this context. I can hear people screaming at their computer screens: “Higher education is not a business.” Folks, other than in the form of a vigorous denial, you won’t hear that expression from me. I’ve said it before, and I’ll say it again: “Higher education is a business.” See my previous post, According to the Duck Test, Higher Education is a Business. If you see an animal in the barnyard that has feathers like a duck, flies like a duck, waddles like a duck, quacks like a duck, swims like a duck, and looks like a duck, then it is a very safe bet that it is a duck.

I believe that much of the difficulty and confusion comes from the fact that education is more than a business. In addition to being required to operate as a business, it is a ministry, an agency of service to individuals, communities, our country and the world. It provides a public and private good. It offers aid, assistance, help and utility. I put it in the same pigeon hole as the fields of medicine, and charitable service enterprises. All of these enterprises offer indispensable assistance and benefits to their clients, communities and the human race. I have heard many call for these initiatives to be held to higher standards of accountability than we demand of the companies from which we obtain our meals and groceries. We seem to have far fewer problems with businesses offering inferior services to customers or clients, than requiring service organizations to maintain their obligations to operate according to the legal requirements that all businesses are suppose to meet.

The past several postings in this series have been about growing enrollment. I believe that American higher education has reached a point of decision at which it must pick between two very different paths. This choice will define unique and important historical options that will have far reaching consequences. If you are completely turned off by the idea that higher education should be described in business and economic terms, will you allow me to use the medical analogy of the health of American higher education? Have we reached a point where the future health of American higher education may conceivably be at stake? Is it time to check its temperature, heart rhythm, AIC, cholesterol levels, BMI and the electrical activity of the brain?

Most educational pundits, critics and commentators, friendly or otherwise, readily admit that American higher education has come through some very trying times and will definitely face some more problems, and possibly even crises in its immediate future. The decisions that American higher education must make can be formulated in a number of different terms. The problems facing American higher education are complex and multifaceted. This means that we must be prepared to wade through knee-deep, involved puddles of mud to get close to understanding the problem before we can formulate and begin to implement a remedy that will alleviate the current difficulties.

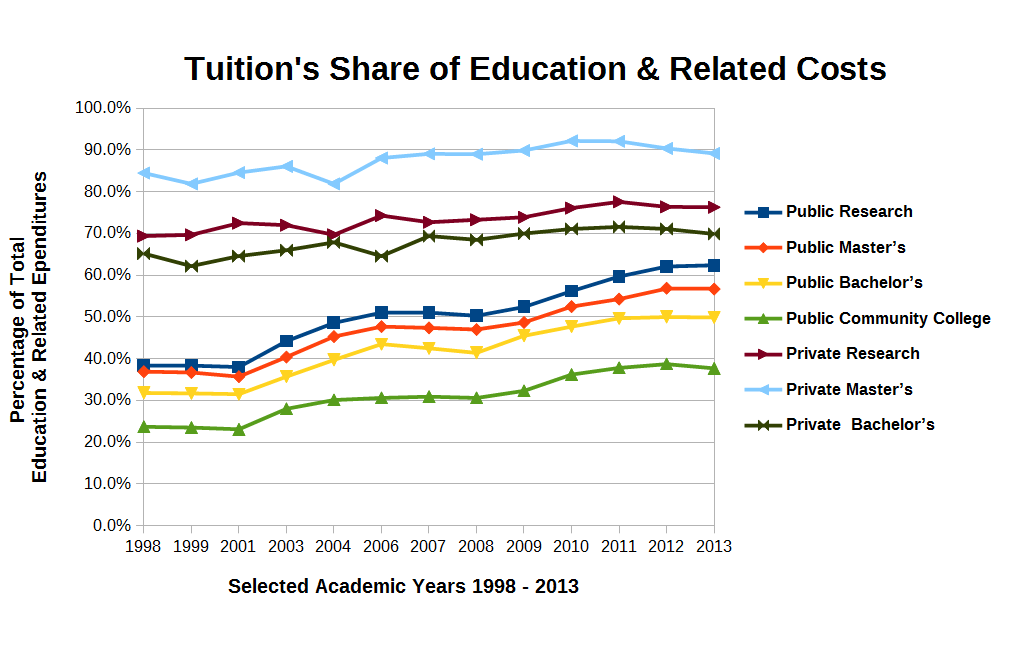

From previous posts in this series, I have tried to present the argument that American higher education is facing financial problems and pressures. The enterprise doesn’t have enough money to do what it’s currently doing. It is also far short of having the funds to do what it and seemingly most of the American public wants it to do. In this series I have proposed that American higher education has five sources of revenue. In the first post of the series, The Business Model of All of Higher Education is Broken, I listed five possible sources of revenue for American higher education:

- Tuition and fees;

- Fundraising, advancement or development efforts;

- Endowment income, appreciation, interest or dividends;

- Auxiliary enterprises; and

- Government appropriations (Reserved for public institutions).

Previously in this series, I have concentrated on revenues from tuition and fees. The two easiest ways to enlarge this revenue pot are either by increasing the tuition and fees charged each student, or by growing enrollment, i.e., increasing the number of students paying the tuition and fees. I have attempted to show that institutions would be fighting a losing battle if they attempted to increase the tuition and fee charges sufficiently to cover their current needs or future desires. Student, families, politicians and the general public already believe that tuition and fees are too high. In the most recent post in this series, The Business Model of All of Higher Education is Broken, Part V: Increasing Enrollments is Not Enough, I began to consider the difficulties in increasing enrollments to gain more revenue. I continue that line of reasoning in this post.

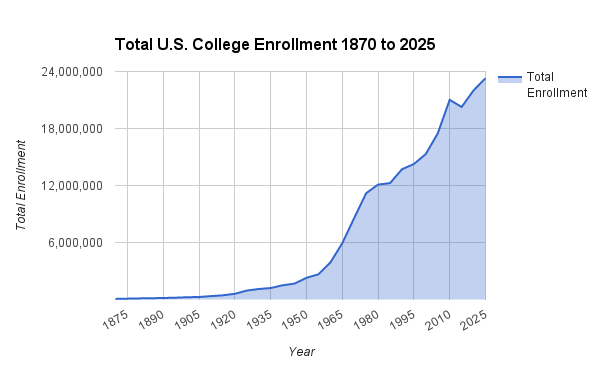

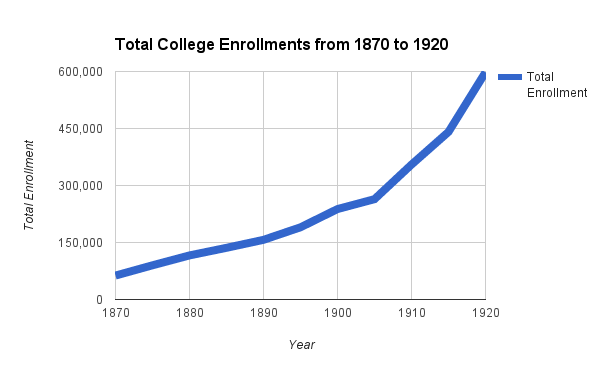

Business strategists, economists and mathematicians typically talk about two types of growth: incremental and exponential. Incremental growth is normally represented on a graph by a straight line. With this type of growth, the number grows by approximately the same amount in each period of time. Its graph is best approximated by a linear function. On the other hand, exponential growth is an upward-opening, concave curved line. In exponential growth, the number grows at a rate that is proportional to the number’s current value, resulting in its growth with time being an exponential function. Its graph is best approximated by an exponential function, with a leading exponent of the independent variable equal to 2 or greater. To illustrate the difference, consider the following fabricated example of college enrollments in a fictitious country.

The graph begins at a point in the history of our fictitious country where the current enrollment is 20 million students. If our country does nothing different year after year, the enrollment would tend to stay constant (bright green line on the graph). The incremental growth graph (red line) is approximated by a straight line with a slope of positive 1. This means that for each year, the enrollment grows by 1 million students.. The exponential growth graph (blue line) is approximated by a quadratic function. The quadratic growth model represents a disruptive change, such as switching to online degree programs, which at first causes a slight decline in enrollment before the exponential growth kicks in. Our Combination Model (the purple line) represents a combination of adding the online program plus the incremental growth from adding students to the traditional programs.

The enrollment numbers for this fictitious country are not completely unimaginable. The current enrollment in the United States is approximately 20 million. According to the Institute of Education Sciences (IES) of the National Center of Education Statistics (NCES), it is expected to growth by almost 5 million students in the next 5 years. For the first 200 years of American higher education, enrollment did double approximately every 10 to 15 years. If you dig into those statistics you will find that those staggering enrollment increases followed disruptive changes in American society and higher education. There were earth shaking events and government reforms that contributed mightily to the enrollment growths. The slow down and eventual leveling off enrollment growths of the past half century would require new earth shaking events or changes to American higher education to put it back on the path to doubling enrollment every 10 to 15 years. However, this growth is exactly what political and educational pundits desire and suggest that American society must have. We have both presidential candidates of the major political parties suggesting that the economic recovery of the United States must be built on the backs of high tech jobs and increased educational opportunities. Both have suggested that we must double the number of college graduates in the next decade. I only see two ways to double the number of graduates in the next decade. FIrstly, we must either improve our college completion rate from approximately 50% to essentially 100%. We haven’t really come close to that goal with high school education and look at all the flak that secondary education is receiving over graduating unprepared students. The second approach is to essentially double the number of students entering college. For my response to this, see my first point.

However, it is not just Americans crying for these increases in higher education enrollments. You have Education Dive’s headline of August 12 blaring out College enrollments to double in next decade. I invite you read this article for yourself and follow the leads in the article to their sources. It is not a pretty picture the author, Jarrett Carter, is painting concerning American higher education. What’s American higher education to do? As with any work of suspense, I break off my story with our hero hanging by his fingers from the edge of the cliff and leave the resolution for another installment. Please stay tuned.