I took my Memorial Day and Independence Day Posts from the first five verses of chapter 2 of Paul’s second letter to his protege Timothy. One focused on the attributes of a good soldier, while the second looked at how to be a winner. I didn’t plan this series of posts to be a holiday series. However, the first two coincided with Memorial Day and Independence Day. This post coincides with Labor Day, which may be very appropriate, as verse 2 opens the door for us to look at the office, qualifications and work of a teacher. It also opens the door for us to look at much more than we can cover in one post. Thus, this post will become a wormhole for us to investigate more fascinating topics dealing with the process and responsibilities of teachers, and the cyclic, self-sustaining patterns of biblical teaching.

It seems very appropriate to look at teaching this Labor Day, since many have declared teaching to be a labor of love. The dictionary definition of a labor of love is work “done as an end onto itself, rather than a means to an end. It is work that benefits others rather than significantly rewarding the laborer materially.” In Paul’s case, it was definitely a labor of love. He did it out of his love of his Savior, the Lord Jesus Christ. Paul also did it for the heavenly reward or benefit that others might receive.

Love is central to all of Christian theology. We love God because He first loved us (I John 4:19). In fact, God loved us so much that he sent His Son to die for us and be a propitiation for our sins. (I John 4:10). Propitation is a big word that means “turning away one’s wrath.” Christ’s sacrifice on the cross satisfied the demands of a righteous God, turning away his wrath against our sin. As demonstrated in I John, the Apostle John could be called the disciple of love. In his gospel, after Mary Magdalene discovered the empty tomb, she ran to Peter and “to the other disciple, whom Jesus loved.”

However, love is just as central to Paul’s view of theology, as it was for John. In Romans 5:8, Paul wrote, “But God commendeth his love toward us, in that, while we were yet sinners, Christ died for us.” In his first letter to the Christians in Corinth, Paul wrote what’s known as the Love Chapter. He begins Chapter 13, with these words “Though I speak with the tongues of men and of angels, and have not charity, I am become as sounding brass, or a tinkling cymbal.” and ends it with “And now abideth faith, hope, charity, these three; but the greatest of these is charity,” The word translated “charity ” could just as easily have been translated “love.” Without love, there is no harmony, only discord.

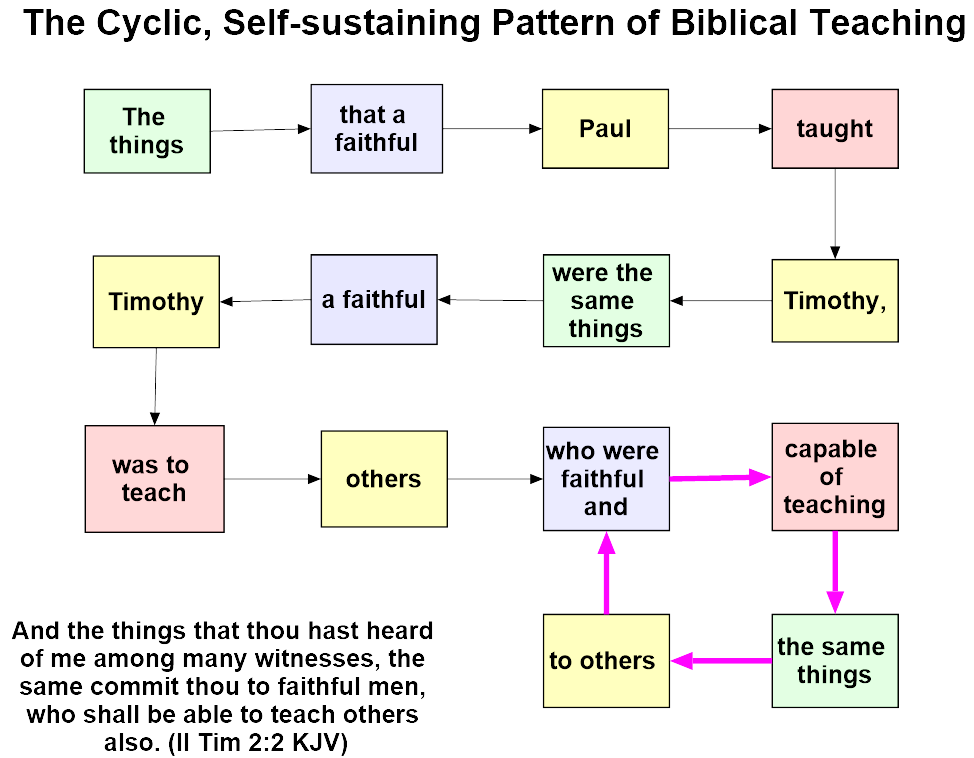

We are to love as Christ loved. However, our love doesn’t originate in us. We can’t generate our own love. It is a reflection of God’s love, as Paul wrote in Ephesians 5:1-2, “Be ye therefore followers [imitators] of God, as dear [beloved] children; and walk in love, as Christ also hath loved us, and gave himself up for us, an offering and a sacrifice to God for a sweet smelling savour.” The Ephesian 5 passage is not the only time Paul talked about imitating Christ. Paul begins Chapter 11 of I Corinthians with these words, “Be ye followers of me, even as I also am of Christ.” Do you see the repetitive pattern starting to form? Follow Paul, as Paul followed Christ. Teach others to follow you, as you follow Christ.

So just as Christ taught his disciples how to love God, Paul is teaching Timothy “the same things.” So what is Timothy to do? He is to find faithful men, capable of teaching others, these “same things.” It is the cyclic, repetitive, self-sustaining pattern of Biblical teaching. It is a labor of love.